AMAZING DEAL – 100K MR for Amex Platinum or 50K MR for Amex Premier Rewards Gold (targeted)

I found out about this deal while casually browsing FlyerTalk today, but the thread was locked and the link was taken away. I immediately got on Twitter to see if anyone was discussing it. After some back-and-forth, I found that Travel Summary has a link to the card! He explains most everything in that post. That is not my affiliate link, although I believe Travel Summary might receive credit — even he doesn’t know, he just became an affiliate today! As always, read his post and decide how you want to proceed.

For me the options were either the 100K Amex Platinum (on $3K spend, $450 fee not waived) or the 50K Amex Premier Rewards Gold (on $1K spend, $175 fee waived first year).

I am already an authorized user on a relative’s Amex Platinum card, and so don’t need the benefits of the Platinum. However, the bonus is so much larger on the Platinum!

My valuation:

I could get the Amex Platinum for the bonus and get 103K MR (with the bonus + spend). I would also have it as a no forex Amex for overseas trips in case. The $200 airline incidentals fee is good per calendar year, so I could get it in both 2013 and the first week of 2014, so that’s $400 off the fee! In other words, my outlay of fees is only $50 on the Platinum card.

If I got the Amex Premier Rewards Gold, I would get 51K with the bonus + spend, and would probably use it for airfare, but would struggle to hit 70K points with my spending. Even though the fee is waived, I would get about 33K fewer points than the Platinum. The $50 I end up paying is more than worth the 33K points for going for the Platinum.

Keep in mind that whichever card you get, you have to have not had it for the past year. Also, you cannot apply for a Platinum card if you got another consumer Amex card (like the PRG, Zync, Green card) in the past 90 days. I have actually never had a Membership Rewards card for myself (I have always been an authorized user on a parents/sibling’s card to help them earn points), so this wasn’t a big deal for me. Kathy (Will Run For Miles) in the comments says she was approved for the Platinum a few months after canceling her personal PRG, although Amex has been shady awarding bonuses lately, so please read the T&C carefully if you currently have a Membership Rewards card! Remember that consumer cards are separate from business/corporate cards!

I applied for 5 cards exactly 50 days ago, and they all hit Experian for me. I put Experian under a credit freeze and when I applied for the Platinum, I was given a phone number to call and a tracking number. I tried to ask the rep to pull another bureau, but he wouldn’t, so I rolled the dice and gave him my PIN for accessing my credit report. A minute later, my gamble paid off, since I was approved! Sure it’s another credit pull, but 100K MR is way too much to pass up, especially if I was semi-targeted. This just means I’ll have to push back my future apps by a little bit (which is fine with me … I’m starting to only care for big limited-time offers nowadays).

I took screenshots the entire way and always saw the 100K offer, so hopefully American Express honors it. My plans for the points? Singapore Suites!

A busy 2012, and looking forward to 2013

In case you missed the last post, I’ve begun blogging with Scottrick at HackMyTrip, blogging about the points world there. Hack My Trip is a great repository of information, so it’s an honor to add whatever I know to Scottrick’s library of unique posts. Ardent readers of my blog (the few of you awesome people there are) will see some repeat posts at first with only a dash of updated information (such as my updated posts on fifth freedom routes today). Fear not, as I have some new posts in the pipeline, but need to lay a “base of information” down in order to write about more advanced points topics.

I thought I’d make one last post on this blog to round out 2012. It has been a busy year for me travel-wise – it’s the first calendar year in which I flew over 100,000 miles! Although the foursquare and FlightMemory nerd in me is proud that I hit JetSetter badge Level 9, as well as 100 lifetime flights in/out of LAX.

In February, I flew to South America on LAN, taking advantage of the “pre-Avios” British Airways award chart to book New York – Lima (stopover) – Easter Island (stopover) – Santiago for 40,000 British Airways miles one-way in business. I booked Lima-Cuzco roundtrip for 9,000 Avios after the “re”-valuation of the currency, as well as Santiago – Lima one-way in business for 20,000 Avios. I then used 30,000 American Airlines miles to fly Lima – New York (stop) – Los Angeles in LAN Business and American Transcontinental Business.

An early morning arrival at Mataveri International Airport on Isla Pascua, the most remote commercial airport in the world.

It’s tough to top that trip, since I got to visit two new countries (Peru and Chile), hike Machu and Huayna Picchu, fly to the most remote inhabited island in the world to see spectacular moai statues and sunsets, and hang out with a friend in her new Chilean city.

But then, somehow, I topped it with my first trip to India. The ensuing trip report has garnered over 46,000 views on Flyertalk, putting it somewhere in the top 40 all-time on that site. I’ve been contacted by people all over the world asking me about that trip. Hell, it’s what convinced me to start this blog, and has led to meeting a lot of amazing travel junkies from all over.

I parlayed the 184,000 miles I earned in the US Airways Grand Slam last year into a few tickets, the main one being a 120,000-mile redemption from LAX to Hong Kong via Europe. I got a seat on SWISS First Class before they shut down partner award availability, and used a connection in Frankfurt to gain access to the First Class Terminal. I returned via Bangkok, Frankfurt, and London, visiting the Thai First Class Lounge and Spa and hitting a bit of luck when my Bangkok-Frankfurt flight was subbed in a few weeks prior with their 777-300ER Suites product.

After first landing in Hong Kong from my SWISS First flight, I seamlessly connected to a flight to Bangkok on Emirates’ A380 First Class product, which was amazing and the crème de la crème of an otherwise Star Alliance-laden itinerary. A few people have told me that that trip report section convinced them to find a fifth freedom route to fly that product on. Finally, I also inserted a 30,000-mile redemption intra-South Asia on Singapore Airlines, to visit Singapore for 16 hours, get to my eventual destination of India, and open-jaw to Vietnam with my sister to see Ha Long Bay.

I don’t know what it says about me that a major highlight of my year was taking a shower on an A380 at 40,000 feet …. twice.

I had to make a second trip to India about 8 weeks later, and opted for a paid ticket on Singapore Airlines, where I earned Aegean Star Gold status in one go (while having my matched Turkish status to make the trip a bit easier). While it was tough to come down from hopping around the world in business and first to kicking it in coach, Singapore Airlines greatly impressed me with their coach service.

The latter half of the year was mainly domestic trips, which I flew primarily on Delta due to my elite status with them. The last few months have been focused more on earning than burning for me … most of the fun occurred with the famous Vanilla Reloads, and I owe much of my 7-figure mileage balance to these cards. Bluebird really changed the game, and when the cards were pulled from Office Depot, a lot of us overreacted (though thank goodness CVS has saved us). I overreacted as well, though I ended up just making a video (that most people seemed to like when I met them at FTU LAX, phew):

My last journey of the year was New York to LA, via Houston and San Francisco. While it seems out of the way, it was in order to catch the 787 Dreamliner on United! Although it did take some hair pulling when they canceled my original Dreamliner segments, I eventually hit 100,000 miles somewhere above Lake Tahoe ensconced in Dreamliner Seat 4A on the Houston-San Francisco leg.

—–

So that was my year in miles and points. Not too shabby. Miles and points have been good to me.

As for next year …. to be honest, I actually don’t have any plans set out for travel in 2013, since I’m really busy for most of the year and will probably end up booking trips with short notice to burn through my miles. Some of my goals are to fly Lufthansa First Class proper (and not just visit the First Class Terminal), Cathay Pacific First, and Singapore Airlines A380 Suites (now that you can book them at the saver level with Singapore Airlines miles). I don’t know where exactly I’ll go yet, but those are the products I want to try. I loved my first foray into Southeast Asia this year … perhaps I’ll go there.

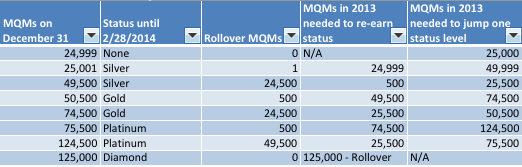

On the revenue side, I ended the year with 49,976 MQMs on Delta, so come March 1, I will be a Silver Medallion until at least February 2015 (since I’m rolling over close to 25,000). I should easily hit Gold in the first half of the year with my yet-to-be-booked domestic trips, though. I don’t know what the future with Delta is, but the optimist in me hopes they don’t switch to a revenue program. As long as they don’t switch, my goal is to hit Platinum Medallion with them (for free award changes), then match out to another program if one seems dandy. I was thinking United, but I’ve been having problems with them with the way their system has messed up my award tickets and their lack of quick customer service that Delta has always provided me. American is too up in the air with a possible US Airways merger, plus I don’t know if I could do 100,000 revenue miles to hit Executive Platinum, since I don’t think mid-tier status with American is that great. We’ll see what 2013 brings!

#FTULAX Review – New Friends and New Digs

New Friends

It was my first ever Frequent Traveler University, and like everyone else, I am bummed that it was over so quickly.

If you’re someone who reads the blogs thoroughly and wonders if FTU is for you — it’s not. But if you’re someone who wants to get to know people in the community and learn some tricks that will never make it to blogs, then by all means, FTU is not enough!

On Friday, after checking in to the Radisson to earn my free stay credit for a more expensive hotel night later, I met the infamous TravelBloggerBuzz (or George, or @FlyerTalkerinA2), who somehow got a better suite than me and breakfast certificates! Whaaat? Right there and then, I knew I had lots to learn! During the cocktail hour, I met loads of other bloggers, tweeters, and miles enthusiasts, and found it easier to just put my @PointsToPointB handle on my nametag. Apparently, people read what I write! Who knew?!

Friday was a pure social session with free drinks, and I eventually headed out to dinner in Culver City with FrequentFlyerUniversity, TravelSummary, JustAnotherPointsTraveler, and @HouseOfV, who taught me a lot about combining points and paid fares for future mileage runs. We later caught up in Santa Monica with GiddyForPoints and MileCollector, who talked to me more about his methods of points-earning.

Saturday’s sessions were somewhat informative, but what I was excited about was crossing off an item on my bucket list by having lunch with TheMrPickles, who explained some of his creative points-earning techniques to me. The sessions ended a bit early, so I ended up being found by MileValue, whom I met in L.A. earlier this year, and was invited to his “standard room suite” for a get-together before dinner, where we talked about the best premium cabin redemptions (although I ended up speaking about the Emirates A380 First Class shower for a while).

We headed out to dinner at the Westchester In’n’Out, quite possibly my favorite fast food location in the world due to its location next to the northern LAX arrivals runway. I got to talk to FrequentMiler for a while about where the reload game was going, and met loads of others to talk about schemes and tactics. I don’t even think we ever sat down in the In’n’Out, we all just stood up and used the decorative ledges as tables while eating and talking points!

Sunday started off with a session all about the secrets that you won’t find on blogs. Depending on your travel habits and risk aversion, just this one session could save you hundreds of dollars. I won’t go into it because we would certainly kill the deals by posting on a concrete and lasting thing like the internet. We followed that up with some sessions to close the day, including two by beaubo from Flyertalk, who told some of the amazing entrepreneurial experiences he used to earn millions of miles at a time (I recommend listening to Steve’s Baht Run story at 14m:52s in this video).

The big guys like Daraius, Gary, and Lucky were quite busy and I wasn’t able to talk to them for a while, but there are future events for that (although I was surprised when Lucky came up to me to say he recognized my handle on my name-tag and thought my stuff was interesting … am I allowed to blush? Do you read this, Lucky? Comment, dude!). Although I did get to speak to Emily from Million Mile Secrets, and it somehow came out that I was the creator of the infamous “THE VANILLA RELOADS ARE GONE” video that Emily is apparently a huge fan of (phew, dodged a bullet there!). I’m so famous, she requested a picture, though I asked if we could use some props for it:

Sunday came to a sad end, and those who came from out of town had to make their way to the airport. I hung out near the bar and talked to those who had red-eyes or late flights. On Saturday, the hotel’s water was closed off due to a burst pipe, and those who stayed at the hotel got compensated as little as 4000 points to as much as 7000 points and a free room. However, it happened during the day, so it affected all of us at the seminars. Someone told me to go ask for compensation and I ended up getting 4,000 SPG points … without even being a guest! At 2.3 cents each, that almost pays for the seminar fee! Score!

I ended up heading out to get Korean BBQ with The Wandering Aramean, Just Another Points Traveler, and others, which was again, loads of fun with tidbits of information that can’t be gleaned from a blog post.

What all am I trying to say from this? It’s that despite subscribing to so many blogs about miles and points, there’s only so much you can learn from words on a screen. Getting to an FTU or Seminar or DO or Meetup really helps you learn things that you didn’t think would be possible. I’m not yet sure if I’ll be able to go to FTU DC in April, but I sure hope I can.

New Digs

One blogger whose work I’ve read since he started blogging is Scottrick at Hack My Trip. We met this weekend and had a genuine mutual appreciation for the unique ideas we had, especially since they seem to complement each other (with Scottrick having his ideas on maximizing fares and me having ideas on maximizing points). Starting today, I’ve decided to publish a few guest posts on Hack My Trip. You can read about my conversation with the founder of the Wallaby Card, who had a 5-minute spiel at FTU this past weekend. Over the course of the next few weeks, I’ll be bringing more ideas to Hack My Trip’s site, and we’ll see where it goes from there. I’ll still have this blog for other points-related things, and will definitely keep my Twitter going, but I want some of my ideas to capture a larger audience.

It was great meeting so many others at FTU — can’t wait until the next one!

#FTULAX this weekend!

I’ll be making the drive over to LAX on Friday, Saturday, and Sunday this weekend for Frequent Traveler University at LAX!

Friday night is the opening cocktail reception. I plan on being there around 4pm, hopefully earlier if I can get some work done. I’ll first stop by the Radisson to check in for my stay to get the free night credit, then will head over to the main event. I still need to figure out where to park my car, and if I’ll stay the night at the Radisson or make the 25-minute drive home.

I’ll be tweeting at @PointsToPointB, with the hashtag #FTULAX, so send me a tweet if you want to meet up. Hope to meet some new and old faces!

PS, if you’re coming from out of town, bring an umbrella! The usually glorious LA weather will not be on display this weekend ….

Mo Cards in Movember

(If you despise posts just about credit cards, skip this. I don’t have credit card referral links — the links in the post are to other blogs’ posts that better explain what I’m trying to say, or to credit monitoring services).

I’d be lying if I didn’t say the majority of my miles/points come from credit cards. I’ve usually been conservative when it comes to applying for cards for myself, only applying for 1 or 2 at a time, letting my credit history grow a little bit. However, I feel like it’s ready for me to “graduate” and test myself with a 3-5 card app-fest. In this post, I’ll explain how I went about with this set of applications:

My goals for this set of applications:

I wanted to avoid Barclay’s and US Bank, since those are the banks I most recently applied to in the late summer/early autumn. I also wanted to avoid Citi, since I’m planning on applying for another set of American Airlines AAdvantage cards once my 18 months from my last applications pass in January 2013. Because of this, I ended up focusing on Chase, American Express, and Bank of America/Bank of Hawaii.

I applied for a couple of cards in March, one cards in August, and one card in October so I chose a date that was 91 days since the August application, just so that I can start setting up a schedule. Frugal Travel Guy wrote why he does a 91-day schedule and it makes sense to me for several reasons. One is that most spending requirements are within 3 months, so you give yourself time to meet spending requirements. Next is that some banks don’t like seeing too many recent inquiries within the last 6 months, so going on a 91-day cycle means that your churn 2 cycles ago is outside of that 6-month window. I’m not going to say I know the rules down to a T, but this is what I’ve learned from experience and from others, and it seems to work.

I’m not really much of a hotel guy, and I would rather collect airline miles than hotel points, and stay at more “authentic” places when abroad. I know a little about hotel programs but don’t really bother with them. After all, this is Points TO Point B, not Points AT Point B. Nevertheless, I figured having a stash of points to fall back on could prove useful, and decided to start racking up some hotel points, particularly Hilton points since they’re so easy to tally up through multiple credit cards and I can see myself using them overseas for otherwise expensive cities.

While coming up with my list of cards, I realized that I don’t actually have a Chase Ink card for myself … the ones that I’ve used for the past several months are as an employee on a family business with others as the primary cardholder. Since the spending requirement recently went down to $5000 in 3 months, I figured I should include an Ink card since I love Ultimate Rewards points for their ability to transfer to United miles (and in case I need a room at a Hyatt, that too!).

I decided to apply for the Ink Bold (card #1), because I figured that when it comes time to possibly apply for a 2nd Ink down the road, it’ll be easier to convince a possible reconsideration representative that I want a Chase Ink Plus because it allows payment flexibility as a credit card, unlike the Bold which is a charge card. It probably doesn’t matter, but I tend to overthink things, and this seemed like a legitimate reason to go with the Bold over the Plus for my first Ink card.

Since I was already doing a Chase business application, I decided to add a Chase personal card to the mix. I already have the Sapphire Preferred and the United MileagePlus Explorer (which I think is the best offer of the year, giving you 55,000 United miles for $1000 spending if you have an active United account). I don’t really care for Southwest points at the moment … before you call me an anti-Southwest elitist (which I probably am!), I actually think Southwest points are great for some uses. I recently learned that if you book a Southwest points redemption, you can cancel your award ticket for free and get all the points back. That’s actually really huge for a commitment-phobe like me. Unfortunately, Southwest flights are tied to the price of the ticket, and I really don’t see Southwest flights being so much cheaper than other airlines for the flights I want to take.

In the end, I decided to go with the Priority Club 80K (card #2) offer on first spend, available here on FT. This is great because it’s easy hotel points for one swipe of the card, and unlike the Chase Hyatt or Citi Hilton Reserve cards, I don’t have to spend thousands of dollars and have only a year to maximize the free night credit (I’m looking for a stash of points to fall back on, I don’t have a specific redemption in mind at the moment). The points will stay in my account for a while to come for any use — I used 5K points for a PointsBreak night in Frankfurt when I had a one-night layover, saving me over $200! The Chase PC card comes with the first annual fee waived and renews at $49 where you get another free night at any property. Sounds great to me!

As for American Express, I decided to go with the no annual fee Hilton 65K offer (card #3) (40K after $750 in 3 months, additional 25K after reaching $3000 in 6 months). This offer ends on November 30th. I’ll use this card at bonus category places like pharmacies and grocery stores at 6x, especially now that Reloads can be purchased at CVS. I could make this a 75K+ signup bonus with that sort of spending. This doesn’t have the elite benefits that the Amex Hilton Surpass or Citi Hilton Reserve cards have, but all I’m trying to do now is start building up a portfolio of Hilton points, and this is an easy way to do so.

Lastly, I decided to go with the Bank of America and Bank of Hawaii Hawaiian Airlines cards (cards #4 and #5). Both offer 35K Hawaiian Air miles for $1000 of spending within the first 4 months, totaling 70K miles. Those 70K Hawaiian miles can be transferred to 140K Hilton HHonors points. The main thing with the BoA/BoH cards was to get a $5K credit line on each, thus qualifying for the Signature Visa and the full bonus. My plan had been to possibly use the miles for a redemption on Virgin Atlantic, but they recently raised the prices for those redemptions by over 100%! 😦

Taking Stock of my Credit Scores:

I have a $4.95/month subscription to Citi IdentityMonitor, which tracks any inquiries that hit my credit report and any changes that occur on my credit report. I also get non-FICO credit scores through there but they seem to be lower than what the scores really are.

I also use Credit Sesame and CreditKarma, but the scores I get on those are abnormally high. I don’t believe it for a second when CreditSesame says I have an 811 score …

Luckily, I got a Transunion score last month from Barclay’s when I closed my US Airways Mastercard that I got the previous year, and that was a true FICO score showing me at 764. My US Bank FlexPerks card gives me a free Experian non-FICO score each month, and mine was 736. While it’s another non-FICO score, Experian is the most popular credit bureau the banks pull in my area (Southern California). Bank of America/FIA sent me notices about my credit shortly after applying that stated that the credit score I had when my file was pulled was 756, but I learned about this a week later. Lastly, I signed up for a trial at MyFico to check my Equifax score, which showed 751. All in all, a good place to start, since you want to stay above 700 when playing this game.

Day of Apps

1. Chase Priority Club 80K — Approved instantly

I started off with Chase and figured that I would probably have to call in for the Ink Bold no matter what, so I started with the Priority Club 80K offer to see if I’d get approved instantly. I did — for a measly $2,000 spending limit. Hah! No worries, though, the bonus is on first purchase and I plan on keeping the card for the free night credit anywhere in exchange for the $49 annual fee, the 10% points rebate, and Platinum status. I don’t actually plan on using it much. Since it’s the end of the year, I’ll make the first spend in late December so that they post in January — I’ll get Platinum via points for all of 2013 and 2014, so even if I give up the card for some odd reason, I’ll still have Platinum status for an extra year.

2. Chase Ink Bold 50K — Approved with a phone call

I then signed up for the Chase Ink Bold 50K with my personal information, which came back with pending status. I got on the phone with the Chase Business reconsideration line — (800-453-9719) — and spoke with a representative about my side business. After a while on the phone, he suggested that I close down my Sapphire Preferred since I “barely use it” (I don’t consider $5000 of foreign and/or travel transactions “barely using it,” dude!). Not only did I not want to give up this line, but my sister is currently abroad using that card because it has no foreign transactions! I can’t let them cancel that!

In the end, I ended up getting them to close my United MileagePlus Explorer card that had a paltry $4K limit and that I had no use for after opening it in March. It’s also the first card with an annual fee next year, so I decided to close that. I’m really surprised that they had me close a personal line of credit to open up a business charge card, but in the end, I have a $5000 flexible spending limit, just enough to get the minimum spending done. I lost a net $2K in credit with Chase, but it was worth getting 50K Ultimate Rewards points and 80K Priority Club points.

3. American Express Hilton 65K — Approved instantly!

After going 2/2 with Chase, I turned my eye to American Express, and got instant approval for $5000! The best part was that they gave me my full credit card information (number, expiration, CVV code) so I got that registered for Small Business Saturday in a jiffy! The card arrived in a few days, and I was able to get an extra $25 gift certificate at a local restaurant.

4 and 5. Bank of America and Bank of Hawaii — Hawaiian Air 35K (x2) — Approved with phone calls

I applied for these in separate browsers simultaneously and got pending status on both. I first called Bank of Hawaii and answered a bunch of questions (including why I applied for 2 … because I want to separate my personal and reimburseable expenses, duh ;)). I’m used to reconsideration calls but this was had me give up the most information, including my major in college (WTF?). The rep congratulated me on a spotless credit report, even wondering how I had an Amex card at age 9 and a Discover card at 14 (gotta love credit reporting agencies!). I was approved quickly.

I then called Bank of America and spoke with a rep who asked me NO questions whatsoever. After about 5 minutes on hold, I was approved with the same $5K credit line – score!

Payout

Impact on credit score

I’ve been keeping track of Credit Karma and Credit Sesame and they’ve been holding steady. Most of my credit inquiries came on Experian, despite applying at so many different banks. However, Bank of America sent me my Experian score after applying for their card, and I was ecstatic to see that it was much higher than expected.

Meeting minimum spend

I’ve actually already met the first spend on my American Express Hilton card, and have drawered that until I finish the rest (I have 6 months to reach the higher threshold). I got the Priority Club card and will make a small purchase on that soon. My Chase Ink Bold came in this week and I’m already over 20% of the way there for minimum spend thanks to Office Depot Visa gift cards and some methods of upping spend. Want to know more? Find me at Frequent Traveler University at LAX this weekend!

Chase Freedom 5x Categories for 2013

How quickly a year goes by! Chase has just announced the 2013 bonus categories for their no-fee Freedom card. Each quarter, the Freedom gets 5% cash-back/5x Ultimate Rewards points at different categories, up to $1500 per quarter. That means that with $6,000 of precise spending, one can accumulate 30K Ultimate Rewards points.

The Freedom is a card that is a mainstay in my wallet, since it has no annual fee. I also got it long before the beginning of this month, when Chase stopped offering their “Exclusives” program, where Chase Checking holders get an extra 10% on base points and 10 points per transaction.

You can activate 5x on the bonus categories starting the 15th of the month before each quarter (so, December 15th, March 15th, June 15th, and September 15th) up until the next quarter’s activation start date. It’s best to activate 5x as soon as possible, though they are retroactive. Interestingly, I was part of a targeted group this year who got to activate 5x for the entire year all at once, though it doesn’t seem like I’ll get to do that next year.

I keep saying “5x Ultimate Rewards points,” which is a bit of a misnomer. The card is marketed as a cash-back card. Each point is worth a penny. However, if you or your spouse/domestic partner has a Chase Sapphire Preferred, Chase Ink Bold, or Chase Ink Plus, you can transfer your Freedom UR points into those accounts to turn them into Ultimate Rewards points that can be transferred to United, British Airways, Hyatt, etc.

Here are the bonus categories for 2013:

January 1 – March 31: (activate December 15th – March 14th)

Gas stations

Drugstores

Starbucks (including Starbucks.com and mobile phone reloads)

The easiest way to maximize this quarter is to buy $1500 of Vanilla reloads at CVS or Walgreens, though I already have my Amex HHonors with 6x and my Chase Ink where I can buy gift cards at 5x to buy reloads. I go to Starbucks a decent amount and get 5x on my Citi Forward. For me, the best incremental category bonus here is gas stations, since the best I get is 2x on my Ink Bold. I’ll use it for gas, then top it off with drugstore purchases in March. (For Californians, Starbucks is an interesting proposition).

April 1 – June 30: (activate March 15th – June 14th)

Restaurants

Movie Theaters

I don’t spend a lot of time at movie theaters, so I guess restaurants are the way to go. I highly value Ultimate Rewards points, mostly for their partnership with United. My Citi Forward gets 5x Thank You Points at dining, which is worth 5 to 6.65 cents back per dollar, but that will be drawered when Freedom has 5x at restaurants, since Ultimate Rewards points are more flexible. In addition, some restaurants sell gift cards to their own places, including some of my local small-business restaurants.

July 1 – September 30: (activate June 15th – September 14th)

Gas Stations

Theme Parks

Kohl’s

Gas stations return for the summer months, and while it might be hard to hit $1500 worth of gas, some places sell gift cards, allowing you to get 5x at other merchants. If you plan a trip to Kohl’s or to a theme park, the Freedom would be a great card to have, since not many cards offer more than 1x.

October 1 – December 31: (activate September 15th – December 31st)

Select department stores (yet to be announced)

Amazon.com

Once they announce which department stores it’ll include, it’ll be easier to figure out how to maximize the 5x for this quarter. Again, my Citi Forward already gets 5x ThankYou Points for Amazon, so I might use my Freedom if I’m not going to spend a lot at the department stores listed. Though it is the holiday season, so department stores will be a heavy category for some.

Even if you do not spend a lot at those particular categories, you can always get gift cards for other places. You can get gift cards at gas stations in Q1/Q3, drugstores in Q1, and certain restaurants for their own cards in Q2. One disappointment is that there are no supermarket quarters at all — earlier this year, I was able to easily max out that quarter with gift card purchases.

Lastly, an interesting side-note — I pinged @ChaseSupport on Twitter from my personal account earlier this week to ask about next year’s Freedom 5x categories, and was told to wait a few more days. This morning, I had a DM with a personal message responding to my question a few days prior with the link to the categories. Now that’s how you do social media!

Getting the most out of Delta’s MQM Rollover policy

There’s only a month left until the end of year, which means that those with elite loyalty status with airlines and hotels are in a rush to reach the next tier … except some of us with Delta. Delta allows rollover MQMs (Medallion Qualification Miles — the elite status counter) and in a lot of cases, it’s better to stay slightly short of an elite status tier and have a bulky rollover than it is to slightly meet that higher tier.

A brief overview of Delta’s elite tiers

Keep in mind that Silver Medallion (FO) is awarded at 25,000 MQMs, Gold (GM) at 50,000 MQMs, Platinum (PM) at 75,000 MQMs, and Diamond (DM) at 125,000 MQMs. Here’s a rundown of major benefits.

Silver is definitely better than no status, and you do not rollover any MQMs under 25,000. While many of the benefits of Silver can be reproduced with holding a Delta American Express, there are a few things you get that non-status members don’t, including:

– 25% bonus Skymiles when flying.

– 1 free bag (on top of 1 free bag with Amex).

– Priority check-in and security (if available to Silver Medallions at airport).

– A shot at upgrades.

Silver to Gold is a huge huge jump for everyone, in my opinion.

– 100% bonus Skymiles (instead of 25%).

– Free Same-Day Confirmed (SDC) Changes on domestic itineraries (down from $50).

– 2 free checked bags.

– Sky Priority – priority check-in, security, and access to Pre-Check without Global Entry.

– Skyteam Elite Plus, Skyteam’s higher of the 2 alliance-wide elite status, which mainly gives international lounge access.

– Free domestic economy comfort at booking. Silvers have to wait until check-in or pay a discounted price.

Gold to Platinum is a great jump for international flyers and for those who have lots of miles to burn in the next year.

– Free international economy comfort (only 50% off for Golds) on Delta and KLM.

– Free award cancellations and changes outside of 72 hours to departure.

– Platinum choice benefit, such as a $200 gift certificate, 20K miles, or SWUs (only usable on highest fares).

Platinum to Diamond is a huge jump for heavy domestic flyers.

– Diamond choice benefit (on top of Platinum choice benefit).

– 125% bonus Skymiles (instead of 100%).

– Free SkyClub membership (you can use the SkyClub when flying any airline).

– Best shot at domestic upgrades.

Taking advantage of Delta’s rollover policy

If you earned status in 2011, that status is good for the 2012 calendar year, and good until February 28, 2013.

If you earn status this year, that status is good for the 2013 calendar year, and is good until February 28, 2014.

I earned Gold Medallion last year, and that’s good until February 28, 2013. I will end the year at 49,976 MQMs, just barely short of Gold again. I will rollover 24,976 MQMs on January 1. However, if I fly 25,024 MQMs before February 28th, I will requalify for Gold before I lose this year’s Gold status.

The huge benefit to that is I will requalify for Gold in the 2013 calendar year, which means that it’s good for the 2014 calendar year and until February 28, 2015! That’s a full year than if I jump over 50K just 2 months prior. And I’ll have 10 months to rack up MQMs for Platinum status, my final goal.

At any other airline, it would be a good idea to get as high of an elite tier as possible before the end of the year, but not so at Delta. If you’re a mainly international flyer who is Platinum, getting Diamond has barely any marginal benefits for you. You get a 2nd choice benefit and 25% MORE Skymiles. However, you need another 75K MQMs in 2013 for Platinum and 125K for Diamond again. If you stop at 124K for Platinum, you only need 26K for Platinum again, which is useful if your travel is dropping off but you want the Platinum choice benefit and free award changes.

My current trips this year will take me over a threshold but I want rollover … what do I do?

There are two good options here … one is to credit to Air France/KLM Flying Blue, where you can credit any Skyteam flight. What makes AF/KLM miles valuable is that they are American Express Membership Rewards transfer partners, so you can always top off any miles you earn. They also allow one-way awards, so there are instances to use Flying Blue miles over Delta Skymiles.

Another option is to credit to Alaska Airlines if you have flights on Delta, Air France, or KLM, all of which are “free agent” partners with Alaska Airlines Mileage Plan. Alaska is only partners with Starwood Preferred Guest, but they also have a Bank of America Alaska Airlines Visa that offers a way to top off Alaska miles. Also, Alaska is partners with American Airlines and other OneWorld airlines like Cathay Pacific and British Airways, so you can earn/use miles on each of those airlines.

Keep in mind, if you switch out the mileage number before the flight, you won’t be able to enjoy your current Delta elite status benefits, so there is a tradeoff.

Recap

Delta has an interesting rollover elite status system, where it might benefit some people to stop just short of a higher elite status threshold in order to situate themselves in a better position for next year’s elite status run.

Some people might benefit more from 2 years of mid-tier status than from 1 year of upper-tier and 1 year of lower-tier. Rollover helps maximize those benefits over the long term.

Alaska and Air France/KLM offer substitute mileage programs in which to bank extra miles.

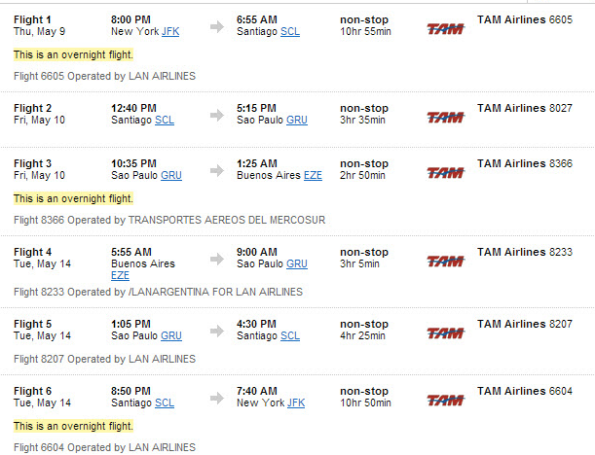

Making sense of mileage earning on the TAM fare sale

Via TheFlightDeal (MY NEW FAVORITE WEBSITE!), there is a great deal to South American cities like Buenos Aires (EZE), Lima (LIM), and Santiago (SCL) from New York, Los Angeles, Miami, and/or San Francisco. We’re talking $300-$400 roundtrip!

However, confusion arises about who is selling the ticket and whose planes are actually flying the routes.

The airline selling the ticket is Brazilian carrier TAM Linhas Aéreas. They are a member of Star Alliance (like United).

However, TAM is currently in the process of merging with Chilean carrier LAN, a member of OneWorld (like American).

The combined airline group, LATAM, is still two separate airline brands in the current short term. That means that TAM and LAN are still separate airlines that belong to separate alliances. Brazilian and Chilean authorities have declared that the new group has to eventually merge into a unified airline. Of course, they also declared that they had to choose one alliance to stick with by August 2012. That decision was deferred to early 2013. It’s highly likely that LATAM will choose OneWorld, because AviancaTaca recently joined Star Alliance and there are anti-trust issues that arise if LATAM joins them.

Why am I explaining this? Because some of the flights that can be booked on this deal are TAM-coded, LAN-operated. This means that the flight number on your ticket is a TAM (JJ) flight number, but you check-in and fly on a LAN (LA) plane. And that affects the mileage earning.

United states that “if you purchase a ticket on a flight that is marketed by TAM but operated by another airline (known as a codeshare flight), the operating airline determines how many miles you earn for your flight.” Because LAN is not a partner of United, you would earn zero United miles on a TAM-coded, LAN-operated flight.

American states that you can “earn miles when flying on LAN Airlines marketed AND operated flights [or] on LAN Airlines codeshare flights operated by oneworld carriers and oneworld affiliates.” However, this is a TAM-coded/marketed flight, so you would earn zero American miles because there is no LAN “code” on this flight.

If the status quo of alliance membership remains, you would have to bank miles from these TAM-coded/LAN-operated flights to either LAN or TAM’s frequent flyer programs (I suggest LAN, for various reasons I won’t get into). If mileage earning is your thing, you should have 24 hours to cancel a current ticket that doesn’t earn miles and rebook another ticket that does earn miles (though I would rebook, then cancel if you really want to make this trip for reasons other than just miles).

It gets kind of complicated, but a good rule to follow is:

For United (and most Star Alliance programs), the METAL matters. Whose name is on the plane determines the miles.

For American (and most OneWorld programs), the CODE matters. You want LAN code on a oneworld partner for AA miles. Not happening with this deal, everything is on TAM code.

If you want to protect yourself on United miles, there are TAM-coded/United-operated flights from LGA/EWR-IAD-GRU (Sao Paolo), then GRU-SCL on TAM metal. You would definitely earn United miles on first two flights, and have access to Economy Plus and redeemable miles bonuses. The Flyertalk Mileage Run thread on this deal has some examples.

BUT, if LATAM decides to join OneWorld before your flight, then all this gets thrown out the window. You would earn zero United miles (because TAM would leave Star Alliance) and earn American miles because both LAN and TAM of LATAM would be in OneWorld.

Maybe this is why Christopher Elliot hates frequent flyer miles.

Citi Forward has a 30K ThankYou Point Bonus

(I don’t have credit card referral links, this card is just one that I have experience with and thought I’d share)

The Citi Forward was (somewhat) my first credit card. It was actually a Citi MtvU card that I applied for in college the day I turned 18. And it was only my first credit card where I was the primary cardholder. I got some interesting bonuses, like 2000 points for a 4.0 GPA (which I achieved once, the semester I tried) or 750 points for a GPA above 3.5 (which was decent enough motivation to study). I also got 100 points for paying on time (always pay in full!). I’ve kept the card open ever since because it has no annual fee and certainly helps my credit score.

Years later, the Citi MtvU card was discontinued and turned into the Citi Forward, but the same general bonus categories remained. The signup bonus was only 10K points, so I didn’t think it was worth signing up for again before they changed my card.

However, via this FlyerTalk thread, there’s an old Citi Forward landing page that is offering a 30,000 ThankYou Points bonus on their Forward, with interesting spending requirements:

- First 10,000 points for spending $500 in the first 3 months (months 1-3)

- Second 10,000 points for spending $1000 in the second 3 months (months 4-6)

- Third 10,000 points for spending $1500 in the third 3 months (months 7-9)

In effect, it’s a $3000 spending requirement but drawn out over 9 months with specific targets in each trimester.

This isn’t the best signup bonus, I’ll admit, but I love the Citi Forward for multiple reasons:

- 5x ThankYou Points at restaurants

- 5x ThankYou Points at bookstores, including Amazon.com

- No annual fee

At 10,000 points, you can redeem for $100 gift cards, so a ThankYou Point is worth about 1¢, so this is a 5% return. If you have a card like the Citi ThankYou Premier, which increases the value of a ThankYou Point to 1.33¢ each, then it’s a 6.65% return for things like airfare. That beats the Chase Sapphire Preferred, which offers 2.14x on dining. I still value 5x UR from the Chase Freedom over 5x ThankYou Points when restaurants are that quarter’s bonus, but I use my Forward the rest of the year for restaurants and Amazon. ThankYou Points aren’t worth much, but when you’re earning them at a rate 3x faster than UR points, it helps your overall return.

Last month, I put a company luncheon on my Citi Forward and paid it off with Bluebird funded by Vanilla Reloads with the company Ink Bold. By doing so, I was able to get 5x ThankYou Points and close to 5x Ultimate Rewards points for one transaction, totaling >10% back (this was before Office Depot stopped selling vanillas, but the idea still applies if you can fund your Bluebird through other means).

The landing page says that you only earn 2 ThankYou Points for restuarants and bookstores, but the Terms & Conditions on the bottom say:

Unless you are participating in a limited-time offer, you will earn five ThankYou Points for every dollar you spend on purchases at (1) book stores, (2) record stores, (3) restaurants, including fast food restaurants, (4) motion picture theaters, and (5) video entertainment rental stores (“qualifying merchants”).

Citi is known for having old offers still available somewhere on the internets, so I would take a screenshot of the landing page if you apply, especially the 5x part on the bottom. They could also change the Amazon.com 5x deal anytime, but I still get 5x as of last month.

I would definitely apply for 2 Citi AAdvantage cards over this, possibly 2 Citi Hilton Reserve cards if hotel nights are your thing. But if you’re looking for a card that you want to keep forever and earn decent rewards on dining/Amazon spend when you’re not churning cards, the Citi Forward is tough to beat.

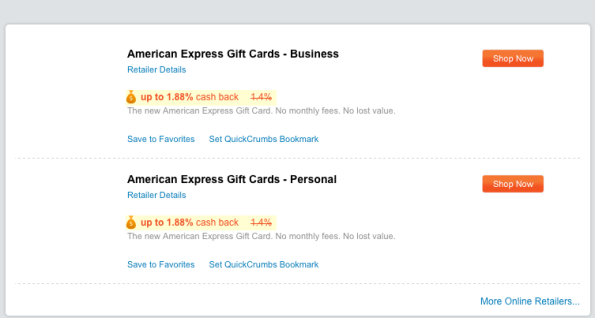

Get 1.88% cash back on no-fee Amex gift cards

Note: I would not purchase these gift cards with Citi credit cards (because they might get coded as cash advances) or with Amex credit cards (because it might initiate a financial review).

If you’re not signed up for BigCrumbs.com, feel free to use my referral link (I do get a credit if you make a purchase through BigCrumbs).

Until Monday 11/26/2012, American Express is offering gift cards with no purchase fees, along with free standard shipping (on cards up to $200). In addition, BigCrumbs.com is offering 1.88% cash back on these purchases, up from 1.4% … just do a search for “American Express Gift Card” on the site.

If you are having trouble coming up with minimum spend for a credit card, Amex gift cards are a good way of fixing that problem. By purchasing an Amex gift card, you are “paying forward” your transactions to either meet a deadline for spending or to get points sooner.

If you purchase a card over $200, you can’t do standard shipping, but there are promo codes such as WRAP12P, which will give you free 2-day shipping. However, BigCrumbs.com T&C says that “Cash back is not offered on fee-free promotional codes.” In the end, if you are buying a $200 gift card, you are getting $3.76 cash back; if you buy a $3000 gift card, you earn $56.40 back. I would just go ahead and pay the already-discounted $3 shipping charge, since you come out ahead anyway with less risk.

The points world has fallen in love with prepaid cards and reloads, but those require fees that eat into your points earned. However, they are easier to unload through ATMs and Bill Pay. These Amex gift cards are more tough to unload, but if you can float this amount of money and can see yourself using them as gifts or methods of payments, it’s a good deal for spending on non-Citi/Amex credit cards (except maybe the Chase Ink family of cards, you’re better off purchasing gift cards with fees for 5x at office-supply stores).